MSCR Notes

Multifamily Structured Credit RiskSM Notes (MSCRSM) are unguaranteed securities designed to transfer to investors a portion of the credit risk associated with eligible multifamily mortgages linked to a reference pool, thereby reducing U.S. taxpayers’ exposure to mortgage default risk. MSCR Notes offer capital markets investors an innovative way to add U.S. multifamily housing market exposure while benefiting from Freddie Mac’s industry leading underwriting and credit risk management standards.

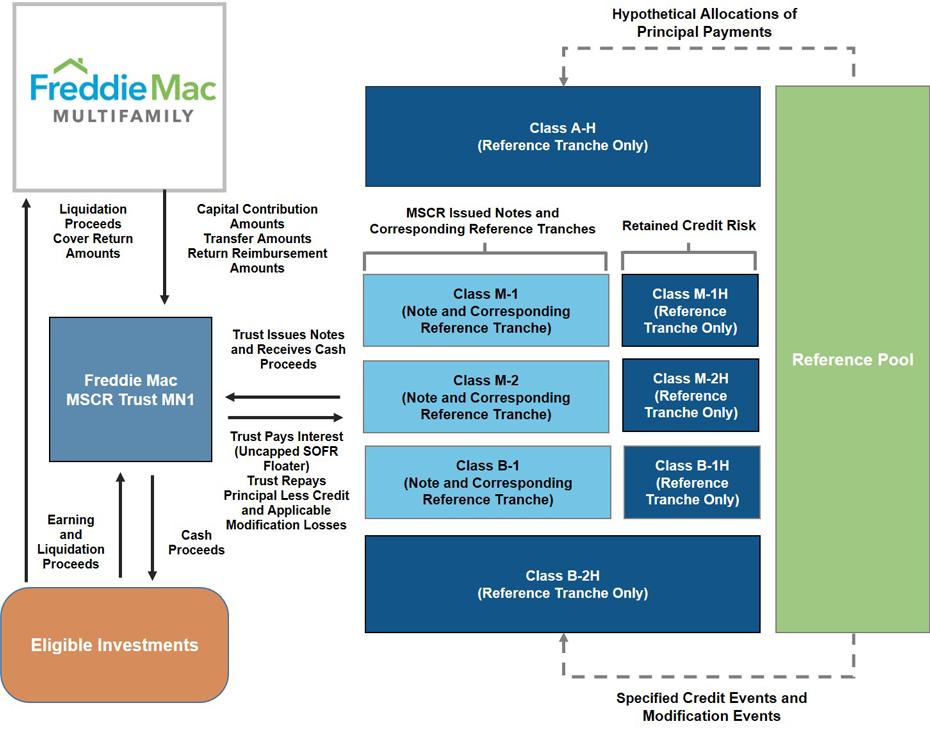

General Structure

In MSCR transactions, a third-party trust issues the unguaranteed notes and invests the proceeds realized from the sale in eligible investments. At closing, Freddie Mac enters into a collateral administration agreement and the capital contribution agreement with the trust and the indenture trustee. Freddie Mac pays a monthly credit premium to the trust and benefits from protection on defined credit or modification events on the reference pool. Freddie Mac will receive payments from the trust that otherwise would have been made to the noteholders to the extent certain defined credit or modification events occur on the mortgages in the related reference pool. The trust makes monthly payments of interest and principal to noteholders.

- Freddie Mac holds the senior risk, the first-loss piece, and a minimum 5% interest in each tranche, all of which are unfunded and not issued.

- MSCR Note performance is determined by credit and payment experience of the reference obligations.

- Actual losses realized from credit and modification events in the reference pool are allocated to the MSCR Notes in reverse order of seniority and reduce the balance of such notes.

- Waterfall triggers are based on delinquency and minimum credit enhancement tests and the failure of either test will change the distribution of monthly principal payments.

- The MSCR Notes will be subject to redemption upon the occurrence of an optional termination event.

Enlarge Image

Benefits

- Diversification: A large and diversified reference pool provides more stable and predictable performance and reduces idiosyncratic risk.

- Strong Underwriting: Reference obligations are underwritten to the same Freddie Mac Multifamily underwriting standards as mortgage loans securitized in K-Deals® and other comparable securitizations.

- Standardized Servicing Guidelines: Uniform across the Freddie Mac Multifamily portfolio.

- Alignment of Interest: Freddie Mac retains a minimum of 5% interest in each tranche to further align interest with investors through the life of the offering. At each MSCR closing, Freddie Mac will execute a European Union (EU) Risk Retention letter.