Our Leaders

Kevin Palmer

Executive Vice President, Head of Multifamily

William Buskirk

Senior Vice President, Multifamily Chief Operating Officer

Lauren Garren

Senior Vice President, Multifamily Technology & Operational Risk

Stephen Johnson

Senior Vice President, Head of Production & Sales

Ian Ouwerkerk

Senior Vice President, Multifamily Underwriting & Credit

Corey Aber

Vice President, Asset Management & Portfolio Surveillance

Michael Case

Vice President, Loan Pricing

Catherine Evans

Vice President, Underwriting & Credit (LIHTC equity, TAH, SBL)

Jason Griest

Vice President, Securitization

Peter Lillestolen

Vice President, TAH Production & Sales

Steve Lineberger

Vice President, Conventional Production & Sales

Nikolaos Makrigiorgos

Vice President, Operational Risk

Tim Meinken

Vice President, Multifamily Chief Financial Officer

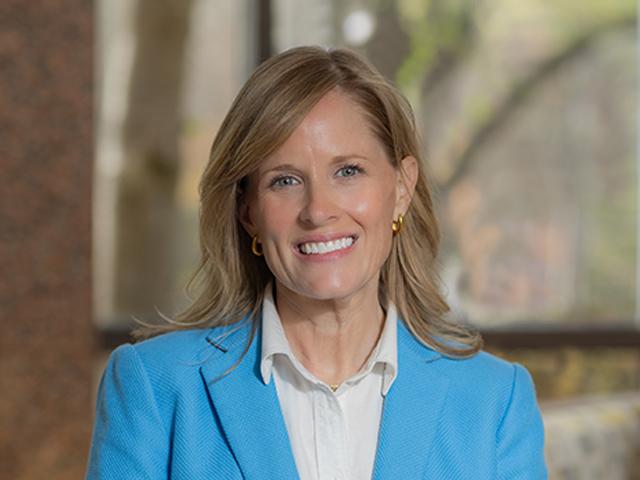

Meg McElgunn

Vice President, Conventional Production & Sales

Carl McLaughlin

Vice President, Loan Servicing

Adam Monti

Vice President, Underwriting & Credit (Conventional)

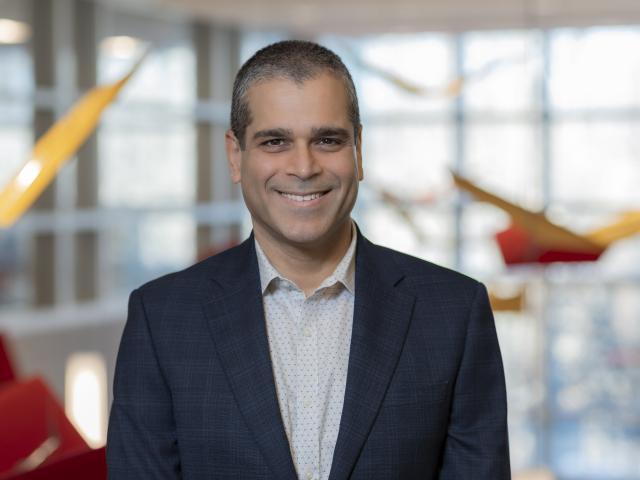

Ameez Nanjee

Vice President, Multifamily Capital Markets

Guy Nelson

Vice President and Deputy General Counsel, Multifamily Real Estate Law

Sharath Sharathchandra

Vice President, Multifamily Portfolio & Risk Management

Erlita Shively

Vice President, Multifamily Counterparty Risk & Compliance