Investor Presentations

The materials below provide an overview and deeper understanding of our wide selection of deals, as well as other important information related to our securitization program.

Investor Presentations

Freddie Mac Multifamily Securitization Overview

An overview of the Freddie Mac Multifamily business, overarching summary of all Multifamily securitization capabilities, including programmatic highlights, and snapshots of our business and collateral credit performance.

-

K-Deal® Investor Overview

Our flagship program, Multifamily K Certificate®, are regularly issued, structured pass-through securities backed by newly originated multifamily mortgage loans.

-

WI K-Deal Investor Overview

When-Issued K-Deal (WI Trust) certificates are bonds that better align our multifamily loan originations with our multifamily securities investors by shortening the period between loan originations and security issuance.

-

Small Balance Loan (SBL) Investor Overview

Our Small Balance Loan program is highly mission driven and generally targets loans between $1 million and $7.5 million for properties nationwide.

-

ML-Deal® Investor Overview

The TEL securitization program is a more efficient, cost-effective alternative to tax-exempt bond credit enhancements for properties with 4% Low-Income Housing Tax-Credits.

Q-DealSM Investor Overview

The Q-Deal program, our third-party loan securitization, is highly mission driven and provides liquidity to small financial institutions, sponsors and originators of affordable collateral.

-

Impact Bonds Overview

We have designed targeted Impact Bonds to help investors focus on overcoming housing challenges and provide support for environmental, social and sustainability goals.

-

Multifamily Participation Certificates (Multi PCs®) Overview

Our Multi PC® program issues both fixed and floating rate 55-day Participation Certificates (PC). Most Multi PCs are secured by loans that have low credit risk, longer terms and/or affordable components. Read more in this presentation.

MSCRSM Notes Overview

Multifamily Structured Credit RiskSM Notes (MSCR Notes) are unguaranteed securities designed to transfer to investors a portion of the credit risk associated with eligible multifamily mortgages linked to a reference pool, thereby reducing U.S. taxpayers’ exposure to mortgage default risk.

MCIP Transactions Overview

Multifamily Credit Insurance PoolSM (MCIP) transactions are insurance-based credit risk sharing transactions that use insurance policies with global (re)insurance companies to cover a portion of credit risk associated with eligible multifamily mortgages linked to reference pools.

-

Seniors Housing Investor Overview

Gain understanding and perspective on our Seniors Housing program, including an overview of our credit approval process and transaction highlights.

Additional Information

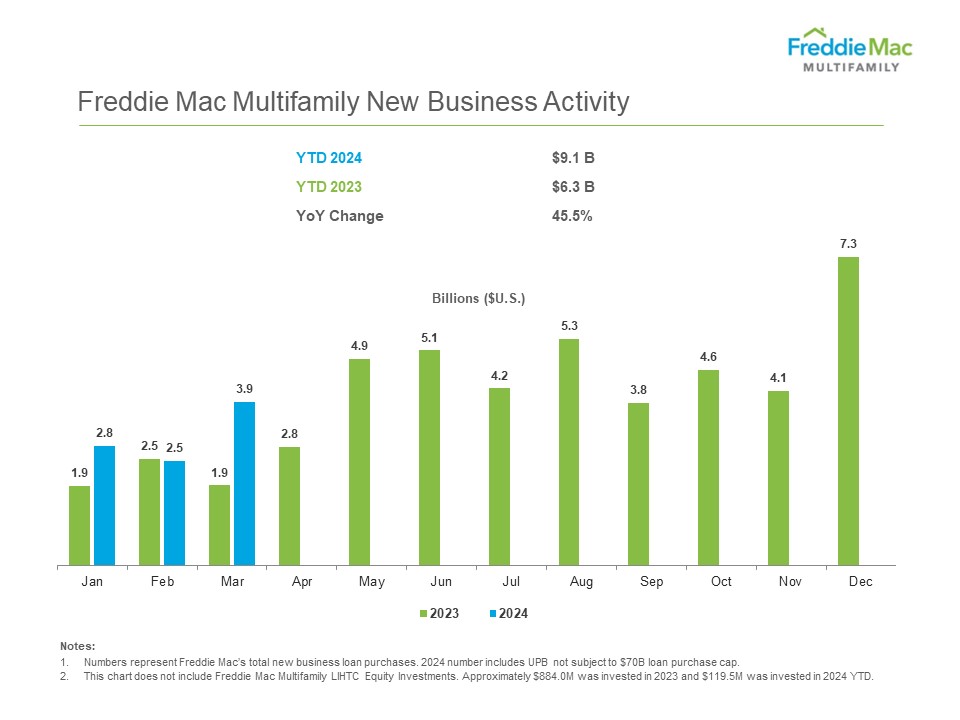

New Business Activity

Take a look at the year-over-year comparison of our new business activity.

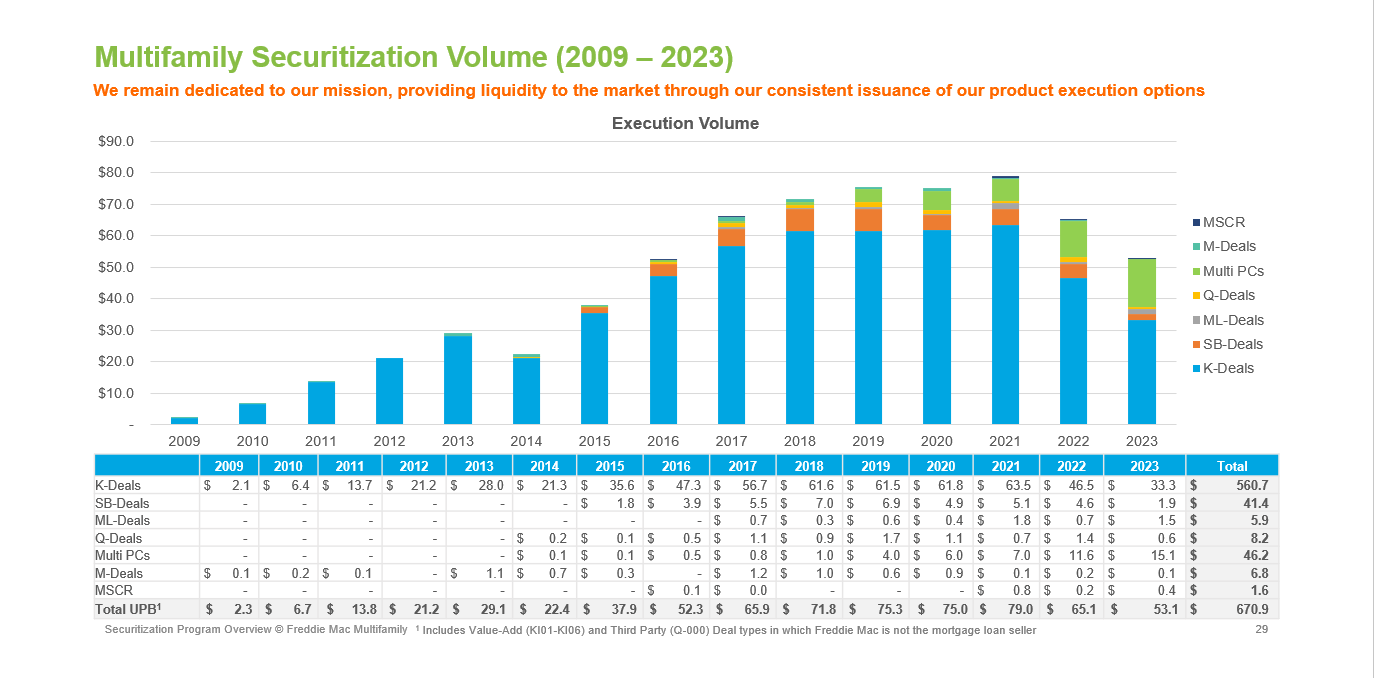

Multifamily Securitization Program Volume

Our K-Deal program has seen unprecedented growth as we continue to diversify our product execution.

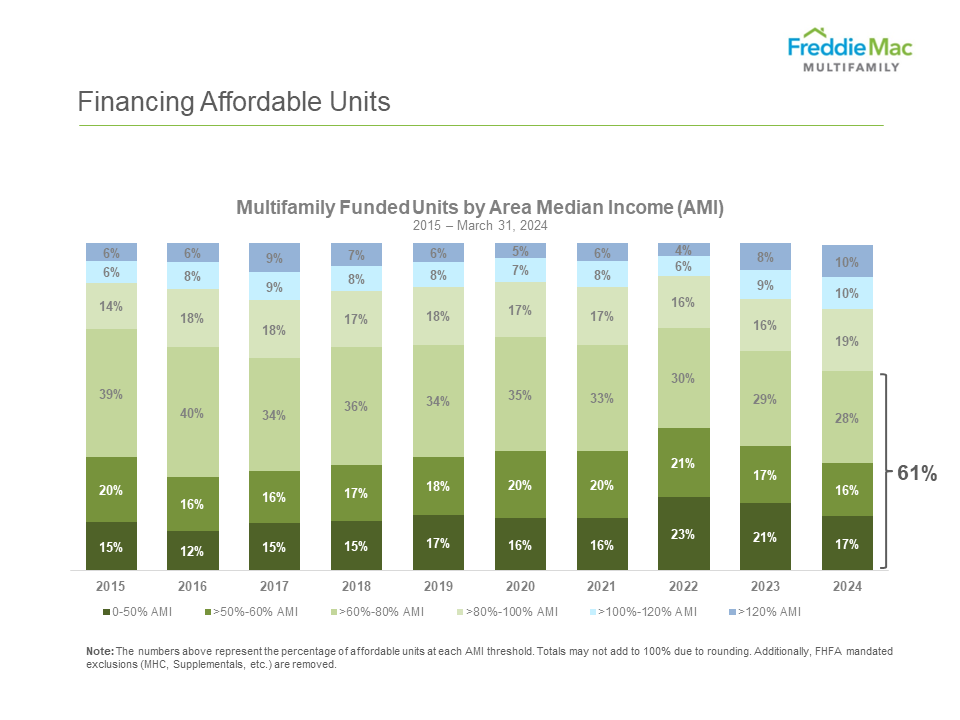

Financing Affordable Units

We help to ensure an ample supply of affordable rental housing by purchasing mortgages secured by apartment buildings.

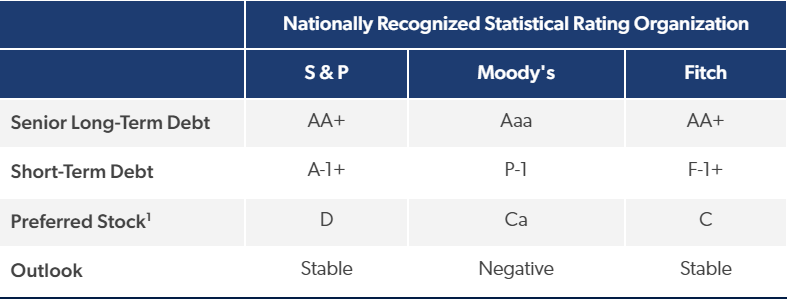

Credit Ratings

Freddie Mac's financial strength, as measured by the three nationally recognized statistical rating organizations Moody's, Standard & Poor's and Fitch.

Fitch Servicer Ratings

Fitch’s most current report on our commercial mortgage servicer ratings.

S&P Servicer Ratings

S&P confirms our commercial mortgage servicer ratings.

.png)

_0.png)