Legacy Structured Credit Risk Notes

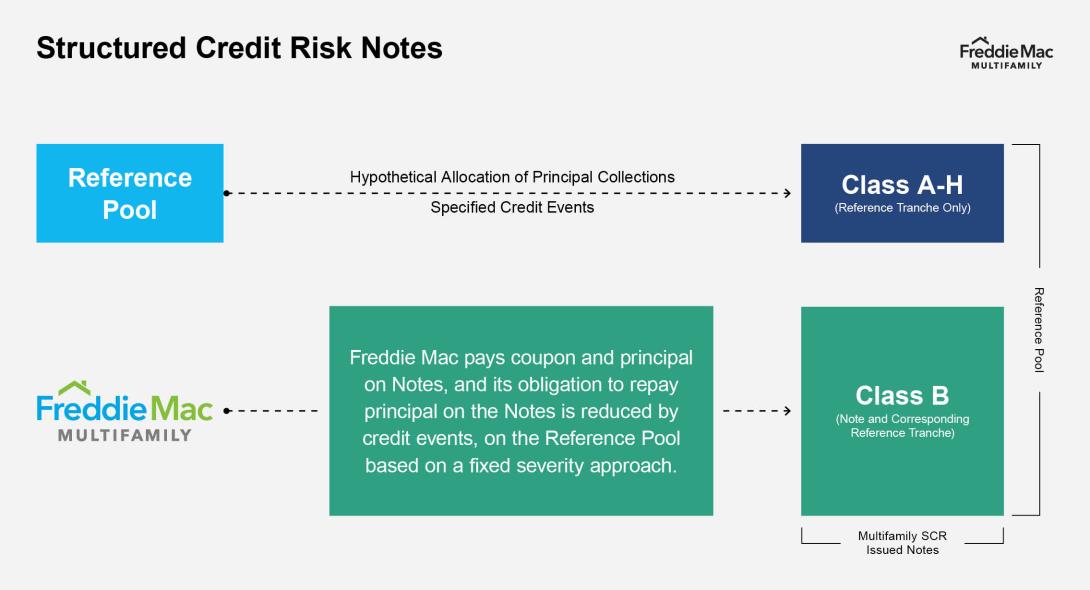

Multifamily Legacy Structured Credit Risk Notes (SCR Notes, pronounced “Score Notes”) are unsecured and unguaranteed Freddie Mac corporate debt. They are subject to the credit risk of an identified pool of multifamily mortgage loans, known as a reference obligations, which are either backing Freddie Mac Multi PCs or for which Freddie Mac is providing credit enhancement for the related multifamily bonds issued by state and local housing finance agencies.

Advantages

- Maintains the standardized servicing guidelines that are uniform across Freddie Mac Multifamily’s entire portfolio

- Applies the same credit and underwriting standards to SCR Note Reference Pool loans as non-SCR Note Reference Pool loans

- Provides opportunities for investment in affordable multifamily assets as well as the municipal public housing market

Characteristics

- SCR Notes offer large and diversified Reference Pools

- Freddie Mac Multifamily holds the senior risk, which is unfunded and unissued.

- B-Piece (or first-loss bond), which is not guaranteed by Freddie Mac, was sold to investors in the SCR transactions.

- SCR Notes have a 15-year final maturity.

- Losses on the SCR Notes are based on fixed severity at more than 180 days delinquent.

- Freddie Mac makes monthly payments of principal and interest on the Notes. The Notes pay principal linked to the principal collections on the reference obligations, subject to principal write-downs.

Key Differences

- SCR Notes are synthetic instruments with cash flows driven by the performance of a reference obligation, instead of actual collaterals tied to a trust in a typical securitization, such as a K-Deal®.

- SCR Notes are unsecured debt of Freddie Mac instead of an agency mortgage-backed security.

- The reference obligations for SCR Notes are not on Freddie Mac’s balance sheet but are guaranteed by Freddie Mac.

- SCR Notes feature the same risk sharing concept as K-Deals, which are REMICs backed by mortgage loans.