Our Results

January 1 through December 31, 2025

We’ve continued to focus on our mission this year.

Below, we describe 2025 results.

Tim Meinken

Multifamily Chief Financial Officer

million

comprehensive

income

We continued to generate strong returns for U.S. taxpayers.

delinquency

rate

Our delinquency rate remained relatively low.

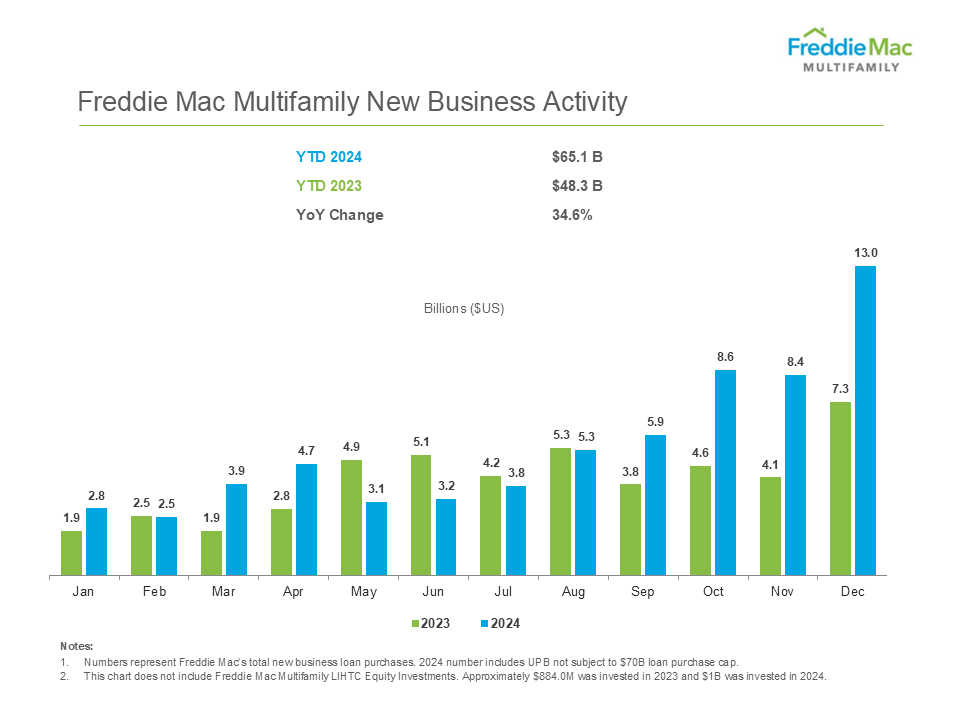

billion

new business

Our loan purchases created liquidity in virtually every corner of the rental market.

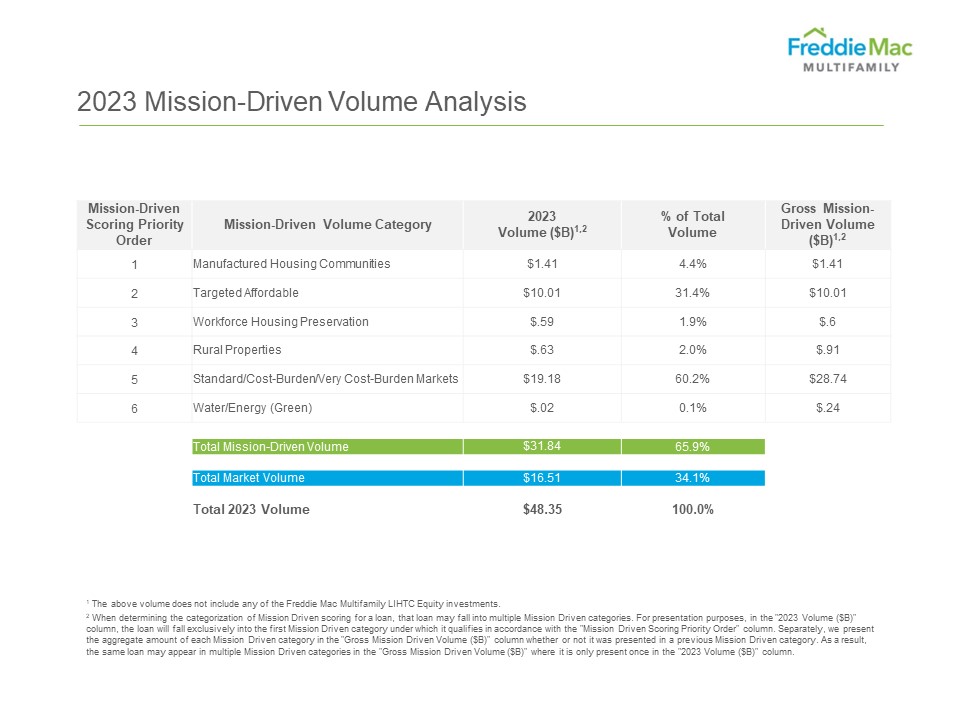

mission-driven, affordable housing

A significant amount of the new business activity (based on UPB) was mission-driven, affordable housing.

affordable

More than 9 in 10 eligible units we financed supported U.S. households earning at or below 120% of area median income.

rental

units

We financed rental units in a wide variety of large, medium and small markets.

billion

credit risk transfers

We engage in credit risk transfer activities that reduce credit risk on our mortgage portfolio and lower required capital.

billion

multifamily mortgage portfolio

89% of our mortgage portfolio was covered by credit enhancements.