Do TEL! Celebrating 10 Years

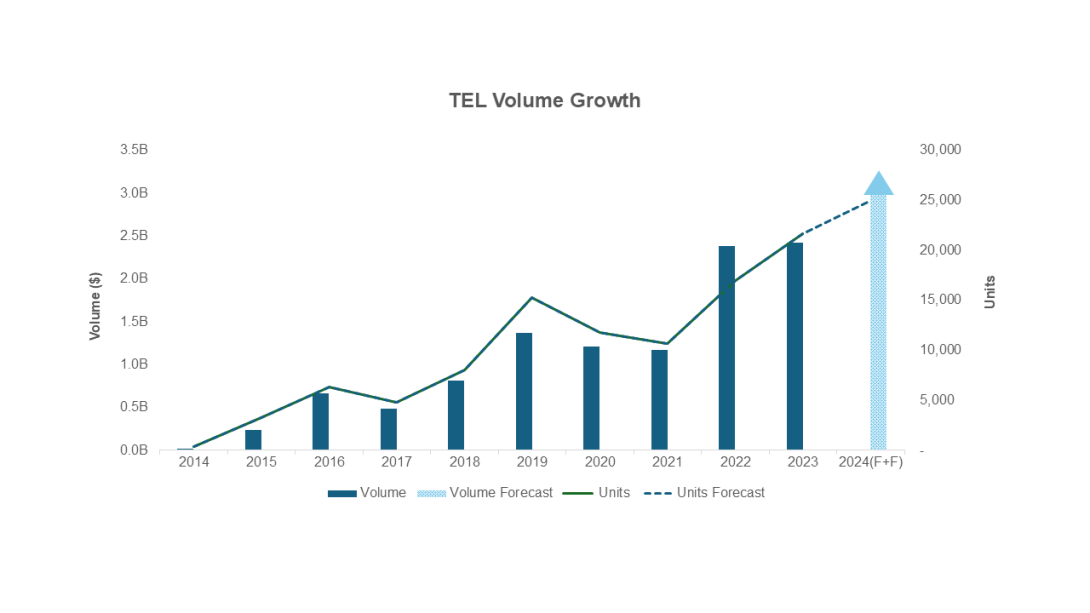

A decade ago, we created and launched our flagship Tax-Exempt Loan (TEL) program. Since then, through this one product, we’ve financed more than 100,000 units of affordable housing and provided nearly $12 billion in funding. More than 40 states plus D.C. have benefited from our TELs.

TELs paired with 4% Low-Income Housing Tax Credits (LIHTC) are critical to the preservation of existing affordable housing — and the creation of new affordable housing nationwide.

The program is so effective because it streamlines the delivery of tax-exempt loan proceeds, saving borrowers money and helping create more affordable housing units. Borrowers like it because they can customize the product: We offer fixed-rate loans as well as forwards, and sometimes 40-year amortization by exception.

No one does more to help borrowers manage interest rate risk. Our Index Lock locks in the Treasury index at any time during the quote or underwriting process. We’ll also hold spread for a minimum of 150 days before closing, and forward commit for as long as 36 months. It’s a great fit for new construction or substantial rehabilitation.

Talking TEL from Our Team

“Ten years ago, Freddie Mac Multifamily created our Tax-Exempt Loan — an innovative, pioneering product that’s grown so much over the past decade.

Let me mention one new project, right in our backyard: the first-ever 100% affordable multifamily housing in Tysons Corner.

What’s fun is that I live close by, and as I’m driving with my kids, I can

point out this brand-new high-rise community being built near the metro. Our $39 million TEL, a forward commitment, is helping create 265 new affordable housing units. We’re working to finance more of this housing — here in our region and across the country."

-Kevin Palmer, Head of Multifamily

“Our goal a decade ago was to simplify a very complex product (bond financing with LIHTC) — so more borrowers could participate to build and preserve more affordable housing.

And we’ve done just that. We’ve saved borrowers time and money — by applying our capital markets expertise to be able to hold spread and rate lock early, and by streamlining our legal execution.

Looking at TEL today, the numbers are extraordinary.”

-Curtis Melvin, Senior Production Director, Targeted Affordable Housing

A special shout-out to our legal team and legal partners who are integral to our TEL program and its success.

TEL-ing Our Story: Inn-OVATION in New Affordable Housing

Affordable housing that doesn’t look affordable. As we entered the lobby, that was the feeling of many of us touring the Ovation at Arrowbrook community in Herndon, Virginia. “It has that ‘wow’ factor,” one Targeted Affordable Housing team member said.

The lobby of the Ovation at Arrowbrook community

The new complex — a few minutes’ walk to the new Innovation Center metro station — features indoor and outdoor community space. Residents can use the fitness center, a game/TV room, a business center with a conference room and study areas, the garage as well as a shaded patio with gas grills and a fire pit.

The sponsor, SCG Development, worked with Optigo® lender M&T Realty Capital Corporation to secure the Freddie Mac financing.

“Our goal is to build properties that look and feel market rate,” Stephen Wilson, SCG Development president told our team. “We feel that it’s important for the buildings to fit within the broader community and not stand out or be of lesser quality.”

“We spend a little more money on things because we own the properties for the long-term,” Wilson added.

The property has gained international recognition: Last year, a visiting group of mayors from Germany toured the property to see how affordable housing is developed, financed and operated in the U.S.

Housing Those in Need

All 274 units are rent and income restricted, and affordable for low- to very low-income individuals and their families. On average, the rents are 26% below market rents.

Some units are also set aside for people with either developmental disabilities or mental illness.

The affordability of the property limits turnover and vacancy, resulting in more stable income than you might find at an unrestricted, market rate property. “Market rate turnover is typically around 50%, and our turnover is about 10-12%,” said Wilson.

Ovation is a mixed-use property — with 38,000 square feet of retail home to a Paris Baguette bakery, a Peter Chang restaurant and an Indian restaurant. The retail space creates job opportunities and additional amenities for the residents.

The deal closed at the end of 2020. The Fairfax County Redevelopment and Housing Authority issued tax-exempt bonds for one part of the complex, “which really worked well with your TEL structure,” noted Wilson. Freddie Mac made an unfunded forward commitment and provided permanent debt, a TEL loan, on both parts of the complex.

Though the buildings look seamless and were constructed at the same time, it’s a “Noah’s Ark of transactions, two of everything,” said Wilson of the 'twinning' deal. The purpose of this condo structure is to allow the use of both 4% and 9% tax credits in the same development.

In part of the complex, income-averaging is used to meet the affordability requirements. That means that the area median income (AMI) of the renters of one unit can float above 60%, up to 80%, as long as another unit offsets it with renter income at 40% AMI, for example.

While this can pose some administrative challenges, it “opens up the market, which I like,” said Wilson. Too often, renters in the ‘missing middle’ earn just enough so they can’t qualify for subsidized housing, yet not enough to afford market-rate rents. “We had a lot of people come in that are slightly over income, and it’s tough to turn those people away,” Wilson said. Income-averaging provides the flexibility to accommodate those situations.

It's just one more way to serve the community — and showcase the results of Inn-OVATION.