2024 Midyear Multifamily Outlook

Through the first half of 2024, the multifamily market continues to feel the impacts of a multidecade, high level of new supply entering the market. While performance is steady, transactions are muted as the market continues to wait for the economic inflection point. Read the full report.

Moderating Multifamily Performance

Our expectations are that the economy and the labor market will maintain positive growth, which will lead to continued multifamily demand. With that, our baseline forecast for 2024 is to see rent growth of 2.7% for the year, which is 20 basis points (bps) lower than the 2000-to-2022 average of 2.9%, according to RealPage, while vacancy is expected to increase to 6%.

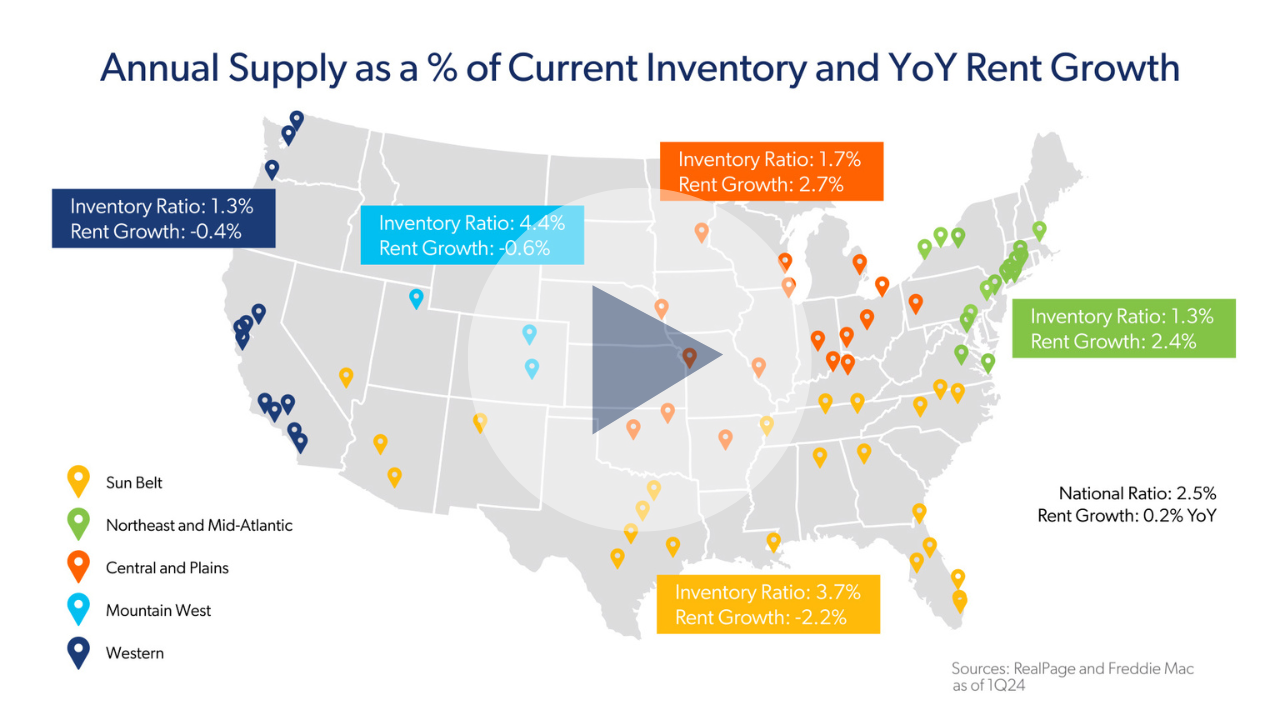

Demand is expected to be strong, but the market will need to work through the cyclical high of new supply this year. New-unit deliveries are generally concentrated in the Sun Belt and Mountain West regions of the country, where demand has been strongest since the pandemic. Metro-level performance will vary, generally favoring less expensive secondary and tertiary markets that are seeing lower levels of supply.

In the unlikely scenario we see meaningful economic slowing this year, the multifamily market would likely see significantly weaker performance. The new supply slated to come to market this year will still likely be delivered, and combined with a weakened economy, will struggle to sustain demand. In that scenario, the multifamily market would see upward pressure on vacancy rates and downward pressure on rents.

Origination Volume Forecast

The multifamily origination market stalled throughout 2023 and continued into the first half of 2024. The lack of volume is attributable to several factors such as high and volatile interest rates, rising cap rates, lower property prices, and more modest property performance projections. By now, most industry participants expected the Federal Reserve to be well on the path of lower interest rates. However, inflation has proved to be stubborn, causing the Fed to hold off rate cuts so far in 2024.

We expect rate stabilization in the second half of this year, which could help boost total multifamily origination volume to about $320 billion for 2024. However, if interest volatility remains high throughout the rest of 2024 and fundamentals slip more, it is possible that 2024 volume looks a lot like 2023.

Although the multifamily market is facing stress from high supply and high interest rates, over the longer term it will remain a favored asset class due to the high cost of for-sale housing, continued economic strength and demographic tailwinds.

To learn more, read the full report or watch the video below.