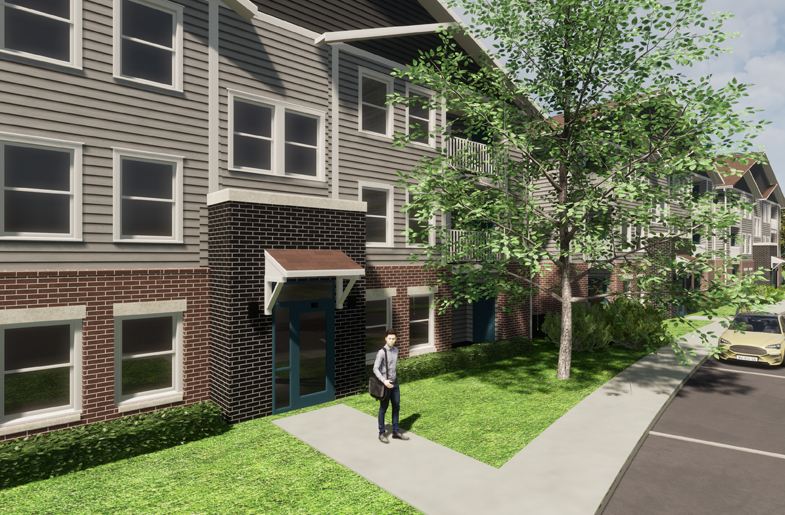

A First in Michigan

Just in: We’ve closed our first tax-exempt loan (TEL) in the state of Michigan to create more affordable housing. Our Optigo® lender KeyBank made the construction loan, and we rate locked a long-term loan that will fund when construction is completed.

“We’re proud to have structured our first TEL in Michigan, my home state,” said Freddie Mac Multifamily Producer Chris Osborn. “We’re thankful for our partnership with KeyBank and Herman and Kittle to bring this deal over the finish line, and excited to finance more tax credit deals in Michigan.”

City Line Apartments

The $23.2 million TEL will help finance a new, 240-unit affordable apartment community with seven three-story residential buildings. City Line Apartments — in Kentwood, Michigan, outside of Grand Rapids — will include a pool, dog park, clubhouse and outdoor entertainment area. All units will be for residents who make 60% of Area Median Income (AMI) or less.

$4.5 Billion and Counting

Michigan now joins 31 other states and D.C. that have benefited from our cost-efficient TELs. We’ve now funded about $4.5 billion with this product since we launched it six years ago.

TELs are important to the tax credit industry and the most cost-effective loans for 4% tax credit transactions. We offer variable-rate loans as well as forwards, so you can customize the product.

And no one does more to help borrowers manage interest rate risk: We’ll hold spread for a minimum of 90 days before closing and forward commit for as long as 36 months. So it’s a great fit for new construction or substantial rehabilitation.