2025 Multifamily Outlook

As of the end of 2024, the multifamily market has proved to be resilient in the face of the highest level of new supply since the 1980s. Fortunately, demand has been exceptional but rent growth over the past year has been modest while vacancy rates have held relatively constant.

For 2025, we predict positive rent growth, but below the long-term average, while vacancy rates are expected to continue to creep up. Cap rates have flattened out, while interest rates remain elevated and volatile, exerting negative pressure on property values. Read the full report.

Steady Multifamily Performance

Based on the assumption of an economic soft landing, we expect the multifamily market to continue to see subdued but positive growth in 2025 as the high levels of new units are absorbed. Although demand has been quite strong recently, high levels of supply are keeping vacancy rates elevated and rent growth muted. With that, our baseline forecast for 2025 is for rent growth of 2.2% for the year, which is 60 bps lower than the 2000-to-2023 average of 2.8%, according to RealPage, while vacancy is expected to increase to 6.2%.

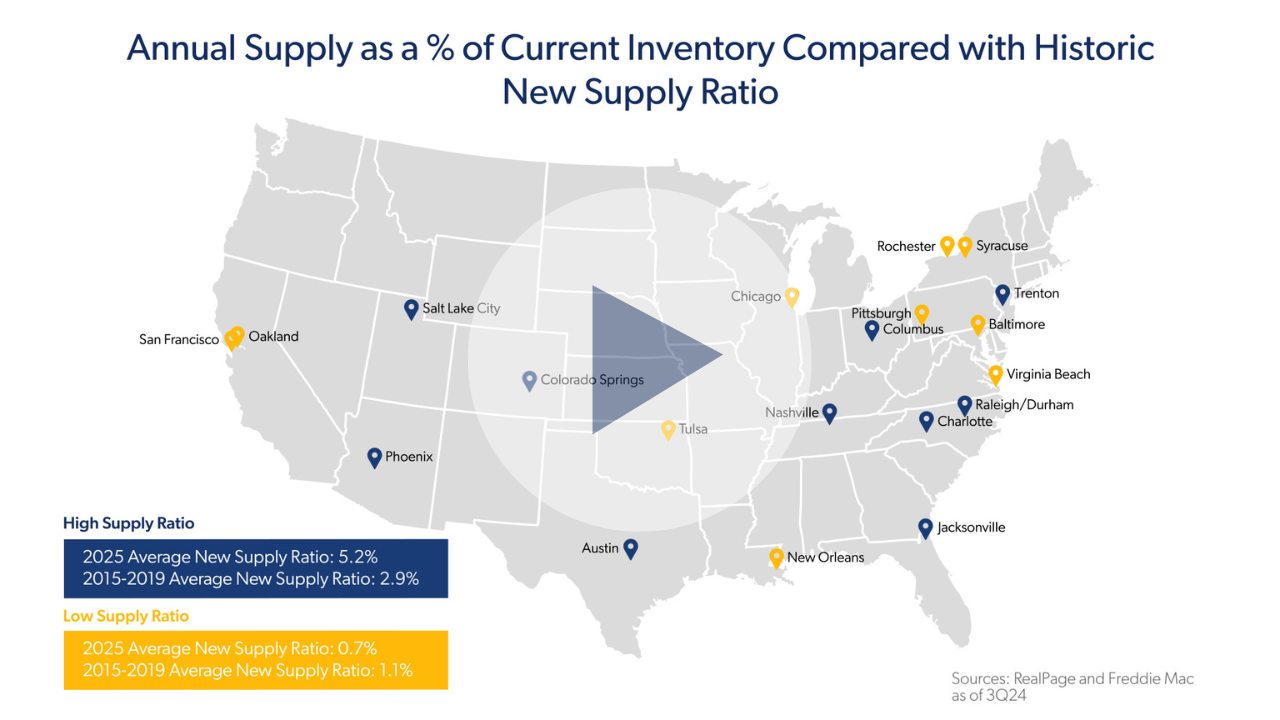

On an individual market level, performance will differ. Generally, metro areas with less supply and that have seen less rent growth since the pandemic will likely outperform, while higher supply markets are expected to have weaker performance. The Sun Belt and Mountain West regions of the country are seeing the bulk of the new supply but are met with some of the strongest demand.

While it is unlikely that we see a recession in 2025, if economic conditions deteriorate quickly, the multifamily market will likely see significantly weaker performance given the high level of new supply entering the market. If that scenario plays out with high supply and materially lower demand, the multifamily market will likely see significant upward pressure on vacancy rates and downward pressure on rents.

Increased Origination Volume Forecast

Multifamily originations have been stalled for much of 2023 and into 2024 as high and volatile interest rates, rising cap rates, lower asset values, and moderating property performance all conspired to slow the transactions market. As rates remain higher for longer and the associated volatility make transactions difficult to close, deals that made financial sense at yesterday’s interest rate may not today.

The multifamily origination market is expected to pick up but will remain below the highs seen in 2021 and 2022. For 2025, we expect multifamily volume to total from about $370 billion to $380 billion. The expected increase is due to a multitude of factors, including a backlog of multifamily transactions that have been sidelined due to the interest rate environment, loans that can no longer reasonably extend and need to refinance, as well as property price and cap rate stabilization.

Supply is still the major factor impacting the multifamily market, but it is a short-term factor — by 2026 it is expected to abate to levels similar to before the pandemic. Overall, despite some short-duration obstacles, the multifamily market is poised for continued growth as there is an overall shortage of housing, an expensive for-sale market and demographic trends expected to support demand for rental housing.

To learn more, read the full report, listen to the podcast or watch the video below.