Our Results

January 1 through March 31, 2025

We had a strong quarter as we continued to focus on our mission.

Below, we describe Q1 2025 results.

Tim Meinken

Interim Multifamily Chief Financial Officer

Contact me for more information or clarification.

million

comprehensive

income

We continued to generate strong returns for U.S. taxpayers.

credit

results

Our credit profile remained solid as of March 31. We had no credit losses, five REO properties on the books and our delinquency rate was 46 basis points.

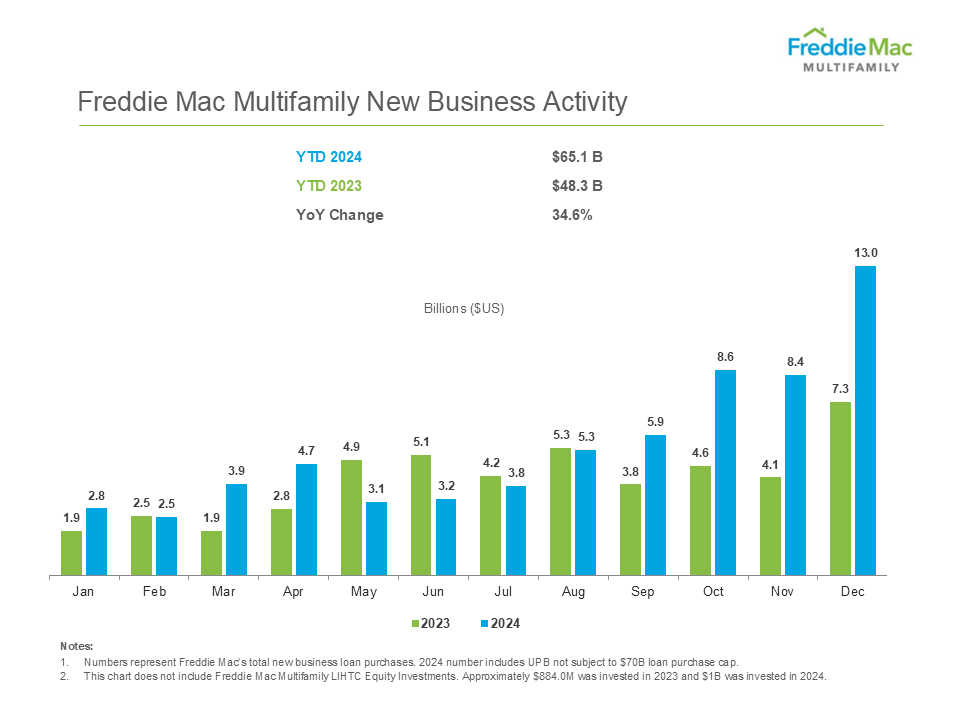

billion

new business

Our loan purchases created liquidity in virtually every corner of the rental market.

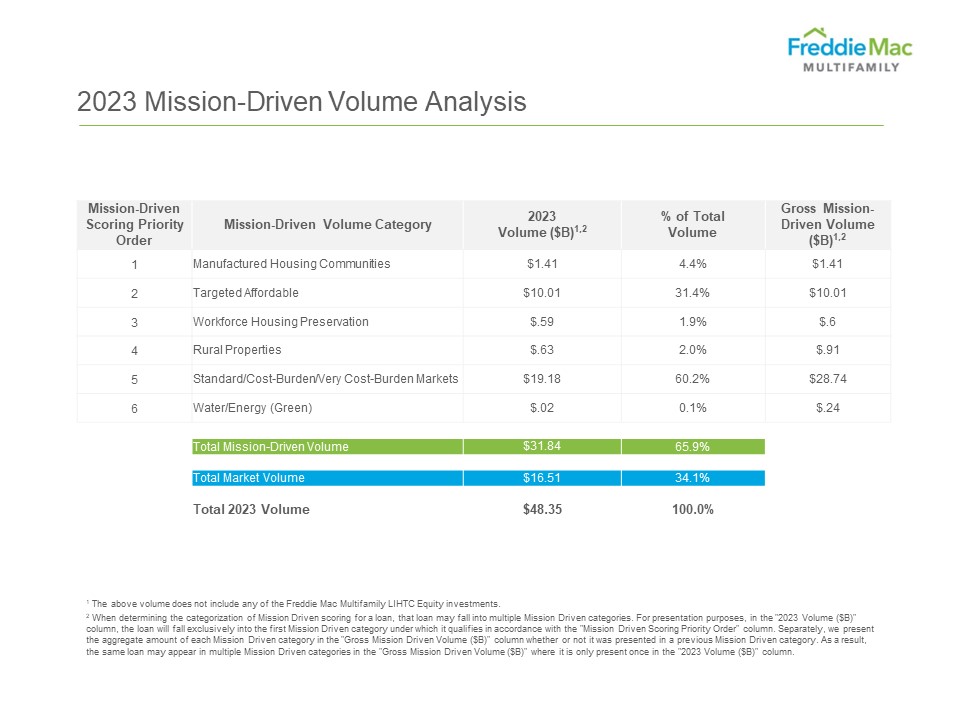

mission-driven, affordable housing

About 65% of the Q1 2025 new business activity, based on UPB, was mission-driven, affordable housing.

affordable

More than 9 in 10 eligible units we financed supported U.S. households earning at or below 120% of area median income.

rental

units

We financed rental units in a wide variety of large, medium and small markets.

billion

credit risk transfers

Since inception of our K-Deal® program in 2009, the company has cumulatively transferred a large majority of credit risk on the multifamily guarantee portfolio.

billion

multifamily mortgage portfolio

93% of our mortgage portfolio was covered by credit enhancements.