Introducing the SBL Prepayment Report

Small multifamily properties – with five to 50 units – represent nearly a third of the multifamily rental market, and much of this housing stock is affordable to low- and very low-income renters. Financing options for this segment have traditionally been more limited than conventional offerings, with fewer lenders and loan flexibility options for these borrowers.

In October 2014, we announced the addition of the Small Balance Loan (SBL) line of business to our lending platform. This program targets loans between $1 million and $7.5 million and offers prepay flexibility to borrowers. Since the program’s inception, we‘ve securitized over $20 billion on nearly 7,800 of these loans with only $2,101,982 in total losses (representing approximately 1 bp of total issuance).

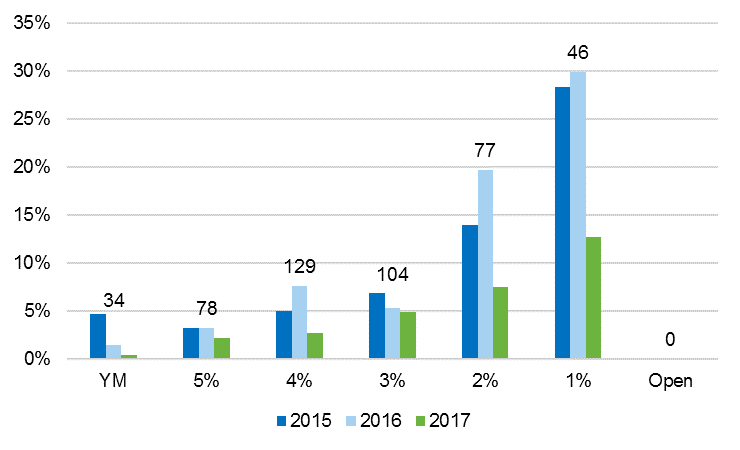

The SBL Prepayment Report leverages our own data and focuses on the voluntary prepayment activity of our SB-Deals from December 2014 through December 2018. We find that prepay speeds increase with loan seasoning and lower prepay penalties, and expect prepayment activity to pick up.

CPR by Loan Prepayment Phase and Payoff Loan Counts

For additional information on the SBL program history or performance, check out these useful links or contact a member of our team.

SB-Deals Structure Overview

SB-Deal Investor Presentation

SB-Deal Performance Data