Multifamily Volume and Pricing Outlook 2017: The Dawn of a New Interest Rate Era

- The 10-year Treasury rate rose to levels comparable to 2014, which will flow through to multifamily market conditions. In the major metropolitan areas, property prices and rent growth are starting to moderate.

- Solid fundamentals and continued economic strength is expected to propel the multifamily market in 2017, even with higher interest rates. Barring an abrupt interest rate hike, which would cause more moderation in the market, price appreciation and volume should continue to grow in 2017.

- We forecast volume to grow to $295 billion in 2017, assuming 10-year Treasury rates remain near 2.5 percent. If interest rates rise as high as 4 percent, volume growth may be lower but still positive, potentially reaching $290 billion.

Multifamily fundamentals supported another year of strong property price and volume growth in 2016. Once the final 2016 numbers are in, multifamily volume is expected to hit another record, driven by increasing property prices, a full construction pipeline, a high number of maturities, and low interest rates. Multifamily fundamentals moderated according to most measures but performed better than historical averages throughout the year because of continued strong demand for multifamily units from renter households and investors.

The multifamily market is poised to experience changes throughout 2017 in response to changing market conditions. The rising-interest-rate environment and moderating fundamentals will affect volume and pricing in the year to come. We believe that interest rate increases alone will have minimal impact on multifamily volume because income growth should remain strong and continue to propel the investor market through 2017.

2016: A Decade-old Era Ends

Interest rates increased 100 basis points (bps), or 1 percent, in 2016 from the trough in July to the peak in December. While the biggest increase came after the presidential election, rates were slowly increasing over the four months leading up to it. Rates increased 40 bps between July and November and an additional 60 basis points after the election through the end of the year. Furthermore, the Federal Reserve moved short-term interest rates higher in December 2016 and March 2017 because of the growing labor market and overall economic strength.

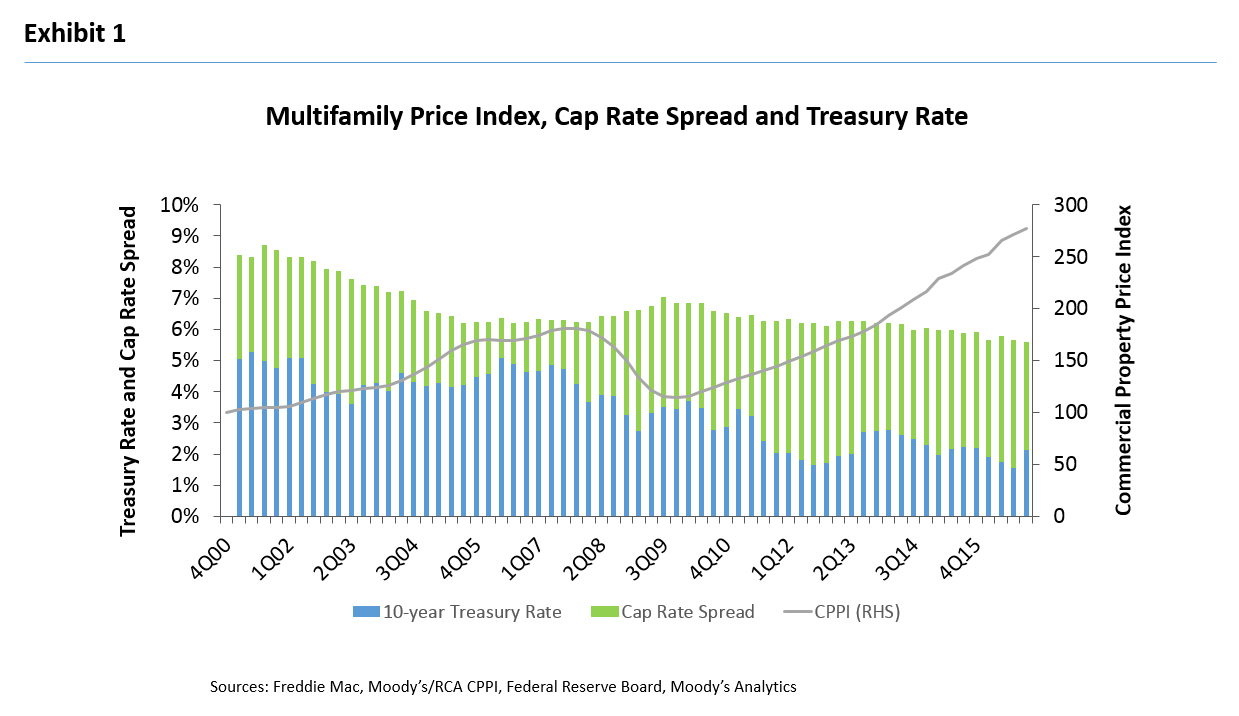

With the Treasury rate up in recent months, cap rates will rise as well. But their path is uncertain. Cap rates remained relatively flat throughout 2016, between 5.6 percent and 5.8 for the full year despite the interest rate increase, as shown in Exhibit 1. Looking at the longer-term history, interest rates are noisy relative to cap rates, which move much more slowly.

So the question now is, if interest rates are moving higher than they have been over the past few years, will the cap rates also adjust upward? If so, how fast? We expect that cap rates will move upward, but not immediately and not to an extent that would weaken the market significantly.

One reason: Historically strong multifamily rental growth continues to put downward pressure on cap rates. We anticipate this will continue throughout 2017. Also, we must consider some of the underlying drivers that may contribute to increasing interest rates. The economy is experiencing inflation stemming partially from increasing wages and rents; it would be surprising in this case if the housing market, where demand continues to outstrip supply, weren't also experiencing rising prices.

Another reason why the cap rate adjustments are not immediate is the time it takes to complete transactions. Deals are negotiated over a period of months, during which Treasury rates constantly move. However, the property price does not adjust immediately. As an example, in fourth quarter 2016, interest rates increased each month but the cap rate decreased from 5.8 percent in October to 5.6 percent in December.

While cap rates did not change significantly due to higher Treasury rates, the cap rate spread – the difference between the cap rate and the 10-year Treasury, essentially the risk premium – tightened over the last quarter due to interest rate increases. Cap rate spreads are inversely correlated with interest rates, so at least some tightening is expected during a period of increasing Treasury rates.

The cap rate spread has been historically wide recently, averaging around 400 bps since 2012, compared to the long-run average of 320 bps going back to 2002. Therefore, cap rates have room to absorb some of the interest rate increases. A similar tightening happened in 2013; after interest rates increased quickly, the cap rate remained relatively flat while the spread tightened. In fourth quarter 2016, the cap rate spread tightened by 60 bps, to 350 bps.

Despite all the volatility at year-end, property prices appreciated significantly in 2016, driven by strong investor demand and property fundamentals. Property prices grew 12.8 percent, slightly below the 14 percent average annual growth seen in previous years, as reported by Real Capital Analytics (RCA). The slight moderation happened mostly in the first quarter, when growth amounted to a 10 percent annual increase, the slowest annual growth since the third quarter 2010. Still, it represents strong demand for multifamily properties. The recovery later in the year proved that market fundamentals and investor views are still favorable to the multifamily asset class.

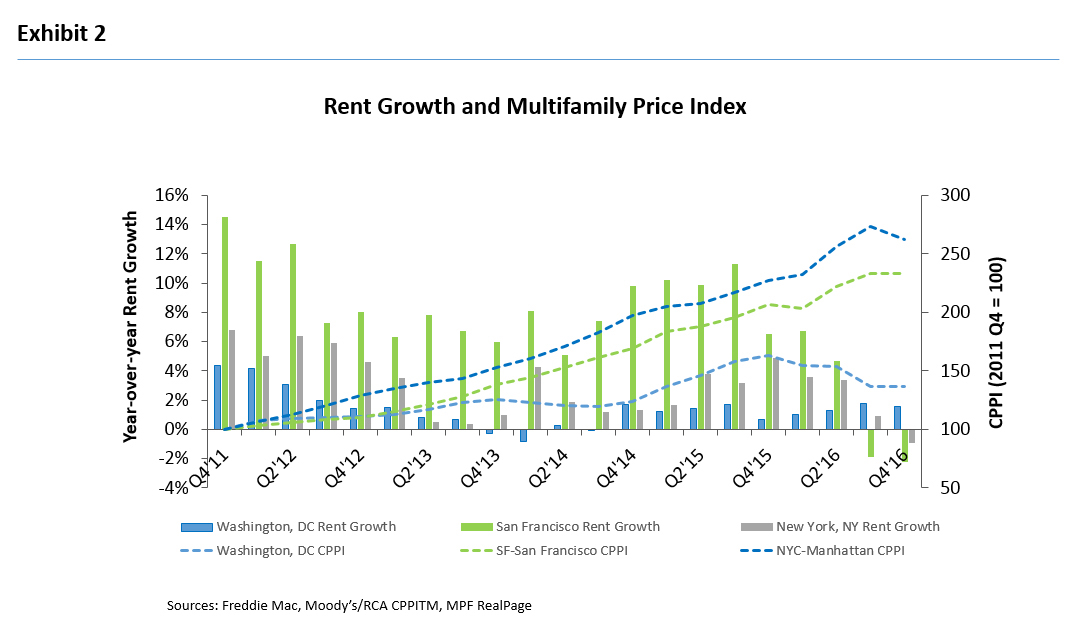

Looking below the national-level performance, the slowdown in property prices in the first quarter was much more pronounced in the six major metropolitan areas, which grew by an average of only 7 percent year-over-year compared to non-major metros, which grew by 13 percent on average. Stronger growth returned to the major metros by the end of the year, as non-major metros barely outpaced them with 12 percent versus 11 percent growth. Since third quarter 2015, the rate of growth in non-major metros has outpaced that of the major metros. This trend is consistent with our findings regarding multifamily property fundamentals. In the larger, gateway markets (such as San Francisco, New York City and Washington, D.C.), rent growth is slowing because of the increase in competition as new supply becomes available, which affects some property price fundamentals, as shown in Exhibit 2. MPF RealPage reported rent declines in New York City and San Francisco over the last year of -0.9 percent and -2.2 percent, respectively. Meanwhile, property prices in the centralized urban cores of Manhattan and San Francisco moderated in the fourth quarter. RCA reported quarter-over-quarter property price declines in Manhattan for the first time since second quarter 2010, while San Francisco saw negative quarterly growth in the first quarter of 2016 and flat growth in the fourth. Likewise, prices in Washington, D.C. declined over the year because of the continuing onslaught of new supply. While rents are growing again in the nation's capital – albeit at modest levels – returns are likely moderating, with property cash flows down as the new supply increases competition.

Turning to mortgage origination, the strength in the multifamily market was evident in another year of record volume growth. We project 2016 volume of around $280 billion, representing a 12 percent increase over the year. The factors were the same as in previous years – increasing property prices, a full construction pipeline, a high number of maturities, and low interest rates.

We are forecasting higher volume in 2016 compared to Mortgage Bankers Association (MBA) based on the strength in property price growth. Final volume numbers will not be finalized by until the last few months of 2017. We see evidence of total origination volume in 2016 to be slightly higher than MBA’s projected $261 billion by the time final numbers come in, but could be lower than our estimate of $280 billion based on slower origination growth near the end of the year and in smaller banks.

2017: A Period of Change and Moderation

According to most forecasters and market participants, the 10-year Treasury rate in 2017 will remain elevated and not retreat to the historical lows of July 2016. A moderate rise in interest rates alone will not be enough to derail the multifamily investment market, however. The engines driving demand for apartment lifestyles will keep running in 2017, leading to continued growth in the market space, albeit at a more moderate pace. Even an interest rate shock to the market – rates rising about 200 bps – would not cause the origination market to fall in 2017, but it would slow the rate of growth.

All else being equal, rising interest rates will moderately benefit multifamily fundamentals. The resulting higher inflation and wage growth will support continued strong market growth and offset some of the stress from higher rates. To understand the impacts of rising interest rates on the multifamily market, we conducted a multi-step process of forecasting cap rates, property price growth and origination volume based on interest rate and rent growth scenarios.

We explored two scenarios:

Basline - The 10-year Treasury rate on average stays flat through 2017 at 2.5 percent and rent growth remains flat at 3.9 percent.

High interest rate - The 10-year Treasury rate on average increases to 4.3 percent in 2017 and rent growth increases to 4.5 percent due to higher inflation and per capital income.

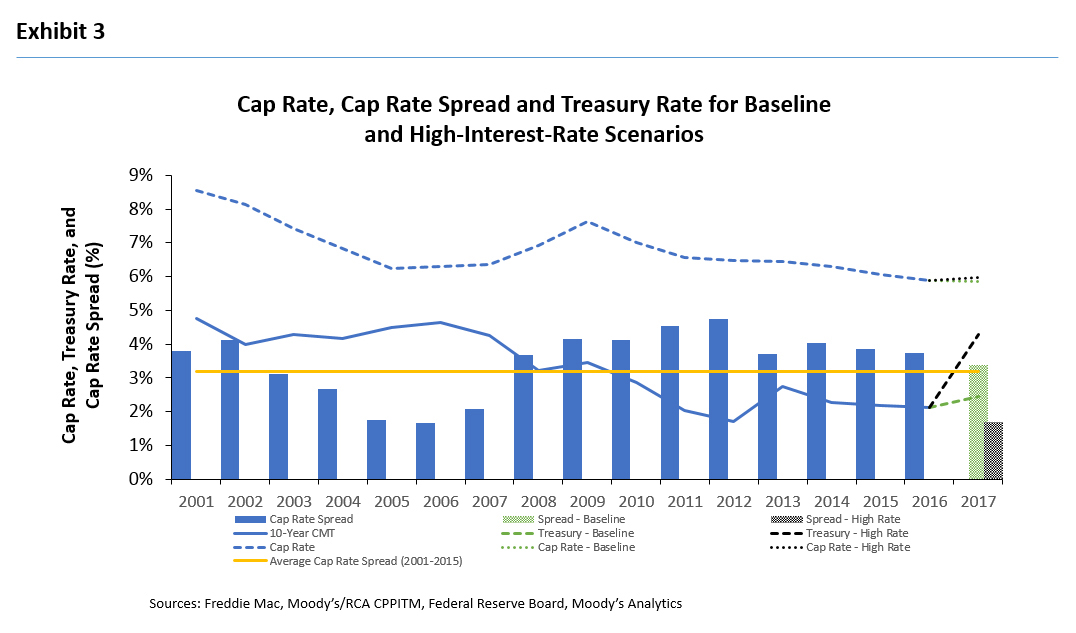

We found that cap rates are sensitive to interest rate movements, but the impact is lagged because it takes time for the market to react to the changes, as shown in Exhibit 3. In the baseline scenario, we project cap rates will remain flat at 5.8 percent in 2017. This represents a cap rate spread of 340 bps, down 10 bps from the end of 2016. Overall, in the baseline scenario, the increase in interest rates has little impact on the cap rate. The wide cap rate spread is expected to absorb some of the increase and the lagging impact of interest rates on cap rates.

In the high-interest-rate scenario, we project the rapid increase in interest rates will affect cap rates more, but still cause only a modest increase to 6 percent in 2017. However, this represents a significant tightening of the cap rate spread, to 170 bps, due to the lag factor. Such an abrupt increase in interest rates will shock the market and valuations will need time to catch up.

This tight cap rate spread is similar to that seen in 2006, but is not a cause of concern. In the high-interest-rate environment, cap rate spreads should eventually feel the pressure to rise in subsequent years. However, we anticipate the spread will remain tighter than the long-run average in the subsequent years. At the same time, higher inflation would accompany this type of interest rate hike, fueling stronger multifamily rent growth, which would benefit the property valuations.

Using cap rate and rent growth predictions, we estimated the impact of these forecasts on property values. In the baseline scenario, property prices are expected to moderate to 4.5 percent growth in 2017 because of the rising cap rate, despite rent growth remaining flat over the year. Property prices in the high-interest-rate scenario are expected to moderate further in 2017 based on the higher cap rate, increasing only 2.9 percent. Despite the slightly higher rent growth expectations, the higher cap rate will compress property values.

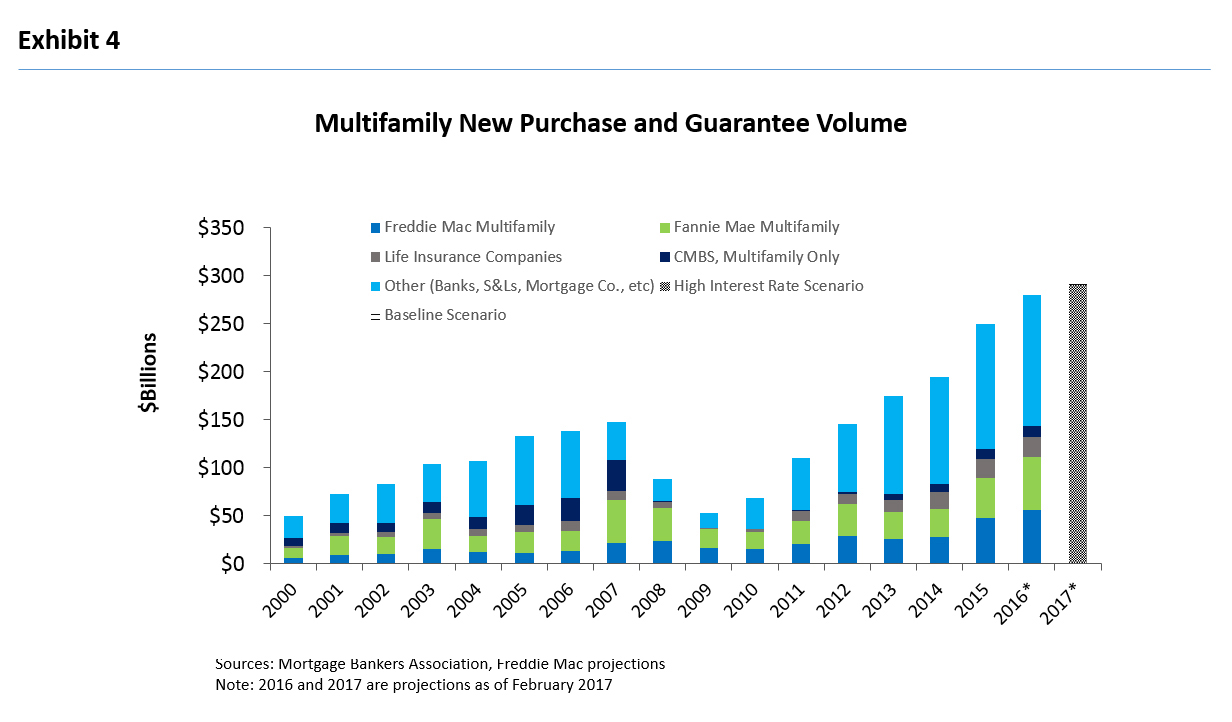

Considering all of these metrics, we forecast 2017 multifamily origination growth for each scenario, shown in Exhibit 4. In our baseline scenario, we project origination growth to continue its upward trajectory but at a slower pace than in the past few years, rising 6 percent, for a total of $295 billion. The growth results from the same drivers as in the past few years: elevated completions, strong fundamentals, a large number of maturities, and – to a lesser extent – lower interest rates. In our high-interest-rate scenario, origination volume would grow only 3 percent in 2017, to $290 billion. Higher interest rates and tighter cap rate spreads could entice investors to look for other investments, suppressing property price growth.

Another, less-likely, scenario is higher interest rates accompanied by negative rent growth. The causes for negative rent growth would have to be localized to the multifamily market, because higher interest rates alone would not be enough to lower rent growth. We assumed the lowest rent growth seen during the Great Recession in this scenario: -2.4 percent in 2009 reported by REIS. In such a scenario, property prices will decline by 8 percent, which in turn will lower origination volume by 10 percent. Using our estimate of 2016 volume at $280 billion, this would put 2017 volume around $250 billion. Even in the unlikely event of negative rent growth, 2017 volume would not drop below 2015's level or decline by levels seen during the Great Recession.

On the whole, we expect the multifamily investment market to stay strong at least through 2017, although to grow a more moderate pace. Rising interest rates alone in 2017 will not be enough to deter the multifamily market; fundamentals are expected to remain strong, fueling investor demand for multifamily properties. We expect interest rates to remain elevated through 2017 and beyond. While an abrupt increase would have limited impact in 2017, subsequent years could be hit harder if the trend continues. However, because investor and renter demand for multifamily units is expected to sustain in the meantime, 2017 looks to be another strong year for the multifamily market.

1 The six major metropolitan areas are Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.

2 RCA breaks the data down by submarkets within San Francisco. Here we show just the San Francisco submarket, which excludes Oakland and San Jose.

3 Origination volume for 2017 is based on Freddie Mac’s projection for 2016 of $280 billion. If final numbers for 2016 are lower than our anticipated $280 billion, we expect the total volume for 2017 to lower, but the overall trends to remain the same.