The Diminishing Supply of Affordable Units

Vice President, Research & Modeling*

Recent research shows that an increasing number of multifamily units are not affordable for low- and very low-income households, and this trend is especially prevalent in the nation’s fastest growing metros.

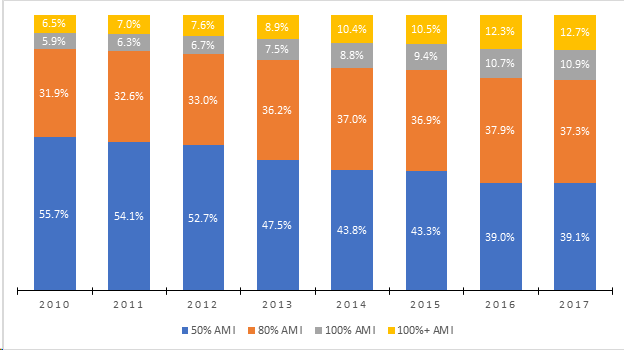

In this paper, we track multifamily rental affordability by comparing Federal Housing Finance Agency data with rent data from the American Community Survey. These results tell the story of how rental affordability has changed since 2010 and finds that it continues to be a national issue that is most pronounced in fast growing metropolitan areas. The chart below shows the breakout of multifamily housing affordability in all metro areas nationwide.

As shown by the blue bars above, the supply of very low-income units has declined sharply since 2010. Meanwhile, the percentage of units unaffordable to households making 100% AMI has continued to increase, and the core driver is rent growth. Median rent for multifamily units has increased 27% since 2010, whereas median income only grew by 6.1% during this time.

When looking at just the Top 50 metro areas in the United States, there is a direct correlation between population growth and the rate of affordable housing decline and this is especially pronounced in the fastest growing metro areas. Nationally, the percentage of multifamily rental units affordable to very low-income households dropped by 16.5 percentage points, compared with 32.7% for the fastest growing metros. Regardless of location, the general trend is apparent: Higher population growth tends to bring about higher loss of affordable units. Read the full report.