Increasing Support for Opportunity Zones

Opportunity Zones are found in each state, are characterized by high poverty and subpar employment opportunities, and allow for the preferential tax treatment of capital gains if these gains are placed into Opportunity Funds. They have created a tremendous amount of buzz in the commercial real estate industry, and for good reason – some industry analysts predict that this tax break will be one of the largest in U.S. history.

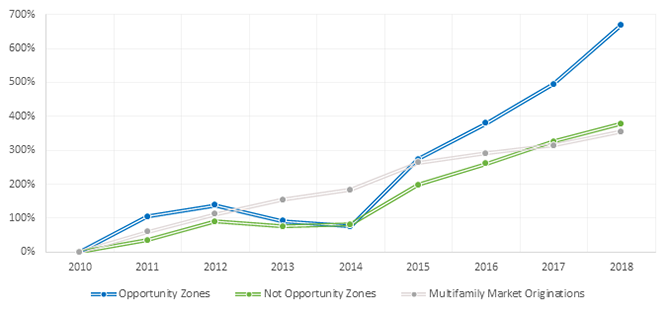

In this paper, we examine some of the multifamily market characteristics in Opportunity Zones by leveraging our own data. We use our past financing activity to show how the multifamily market in these areas differs across the country and demonstrate how this segment of our business fits into our broader goal of providing affordable housing to populations most in need. As seen in the graph below, the share of our business in Opportunity Zones has substantially outpaced the growth of business outside these zones.

We find that Opportunity Zones have historically contained a large number of multifamily rental units that are affordable to very low-income households. These areas often have a higher proportion of small- to medium-sized multifamily properties, which tend to cater more to lower-income renters. Both of these business areas are very important and have been a focus area in recent years.

For additional perspective on the potential risks for both communities and investors, check out our March 2019 Opportunity Zones overview report.